How to Apply for Monzo Flex Credit Card Step-by-Step Guide

Introducing Monzo Flex: A New Way to Manage Your Finances

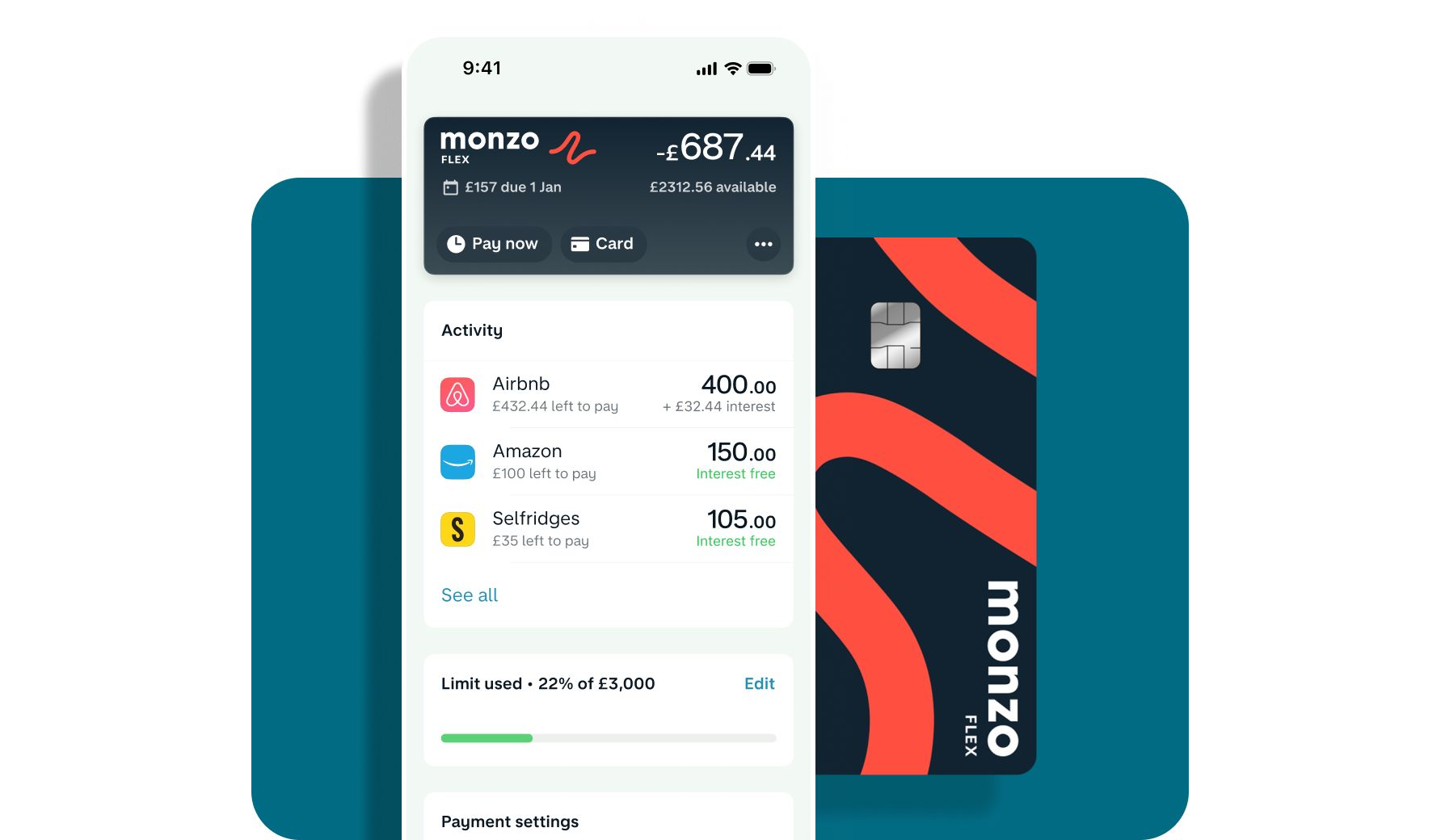

Are you looking for a way to make your purchases more manageable? If so, meet Monzo Flex—an innovative financial solution for the UK market. Monzo Flex offers a unique approach to credit by ensuring that you can spread your expenses over time, making it a flexible and convenient alternative to traditional credit cards. Whether you’re buying a new smartphone or dealing with unexpected car repairs, Monzo Flex lets you pay off these costs in manageable, interest-free installments.

A Simple and Hassle-Free Application Process

One of the key advantages of Monzo Flex is its hassle-free application process. Imagine unlocking financial freedom with just a few taps on your smartphone. That’s all it takes to set up Monzo Flex, which is integrated into the Monzo app to provide you with seamless service. This user-friendly process means less time spent on paperwork and more time enjoying your purchases without immediate financial strain.

Real-Time Insights and Budget Control

Monzo Flex isn’t just about spreading payments; it also helps you maintain control over your finances with real-time insights and budget features. As part of the Monzo app, you have access to an in-depth view of your spending habits, ensuring you can make informed financial decisions. Want to keep track of how much you’ve spent? Or maybe see how an installment plan fits within your monthly budget? Monzo Flex makes it all accessible at your fingertips.

Benefits of Choosing Monzo Flex

- Interest-Free Payments: Spread the cost of purchases without having to worry about extra charges.

- Flexibility: Options to pay for your purchases over different periods, adapting to your financial situation.

- Integration with Monzo App: Use with ease, with all transactions and insights in one place.

In conclusion, Monzo Flex is a smart and efficient way to handle expenses, providing not just flexibility in payments, but also delivering valuable financial insights. This makes it an excellent choice for managing your money the smart way. By adopting this fresh approach to credit, you’re not only streamlining your finances, but also ensuring they remain manageable and stress-free.

Unlocking the Benefits of the Monzo Flex Credit Card

1. Flexible Repayment Options

The Monzo Flex Credit Card provides exceptional flexibility in repayment for the purchases you make. Unlike traditional credit cards that require a fixed monthly payment, Monzo Flex allows you to choose a repayment schedule that suits your financial situation. You can spread your repayments over 3, 6, or 12 months, all with zero interest. This can ease financial pressure, helping you manage larger purchases like a new appliance or holiday travel.

Tip: Plan your repayments according to your cash flow. Opt for a shorter term if you have predictable income streams to eliminate your debt faster, saving you on interest over time.

2. Transparent Fees and Charges

With Monzo Flex, you’ll find a commitment to transparency in fees. This card clearly outlines what you may be charged and ensures no hidden fees sneak up on you. You won’t get caught off guard by unexpected charges, allowing you to manage your finances with confidence and clarity.

Tip: Regularly review your transactions and statements via the Monzo app. This habit will keep you on top of your spending and any associated fees.

3. Seamless Integration with the Monzo App

The Monzo Flex Credit Card is seamlessly integrated with the popular Monzo app, giving users complete control over their finances from their mobile phones. Track your spending in real-time, set budgets, and receive instant notifications. This integration turns financial management into a stress-free experience.

Tip: Use the app’s budgeting tools to categorize your spending and set limits. It’s an effective way to ensure you’re spending within your means.

4. Interest-Free Periods

Enjoy an interest-free period for a set duration on your purchases. This can significantly reduce the cost of using your credit card compared to others that immediately begin accruing interest. Leveraging this feature wisely can enhance your purchasing power without accumulating debt.

Tip: Plan your big purchases around the interest-free periods to maximize savings. Always try to pay off the balance before the end of this period.

SEE HOW TO GET YOUR MONZO FLEX CREDIT CARD

| Category | Description |

|---|---|

| Flexible Payments | Pay for purchases in manageable installments, easily fitting into your budget. |

| Instant Notifications | Receive real-time updates on your spending, ensuring close financial management. |

To further understand the advantages of the Monzo Flex Credit Card, we can delve deeper into its features. This card empowers users by providing flexible payment options, allowing them to split expenses into manageable installments. This is particularly beneficial for larger purchases, as it enables individuals to budget effectively without the stress of upfront payments. Additionally, one of the standout aspects of the Monzo Flex Credit Card is the instant notifications feature. Each time a transaction occurs, users receive immediate alerts. This promotes not just financial awareness, but also helps in tracking spending habits and preventing unauthorized transactions. With such tools at your disposal, managing your finances becomes seamless and transparent. By leveraging these features, users are not only gaining control over their financial decisions but are also better equipped to make informed choices. This innovative approach to credit offers a modern solution to traditional financial challenges, making it an appealing option for various lifestyles.

Requirements for the Monzo Flex Credit Card

- Age Requirement: To apply for a Monzo Flex Credit Card, you must be at least 18 years old. This ensures applicants have a basic level of financial independence.

- Residence: You must be a resident of the United Kingdom. Monzo services are tailored specifically for UK residents and compliance with local financial regulations.

- Current Account: Applicants need to hold a Monzo Bank account, as the credit facility is integrated with their existing services. This allows for seamless management through the Monzo app.

- Credit History: A fair or good credit score can significantly increase your chances of approval. Monzo will evaluate your credit history as part of the application process to assess financial responsibility.

- Employment Status: While Monzo does not specify a minimum income, proof of consistent income is crucial. Having a stable job or reliable income stream demonstrates the ability to manage credit responsibly.

- Identity Verification: Prepare to present valid identification documents, such as a passport or driver’s license, to verify your identity as part of Monzo’s commitment to security.

VISIT THE WEBSITE TO LEARN MORE

How to Apply for the Monzo Flex Credit Card

Step 1: Visit the Monzo Website or Download the App

To begin your application for the Monzo Flex Credit Card, you can either visit the official Monzo website or download the Monzo app via the App Store or Google Play. Using the app provides a more streamlined experience as it allows you to manage everything from your smartphone.

Step 2: Log In or Create a Monzo Account

If you are already a Monzo user, simply log in using your existing credentials. New users will need to create an account by providing your basic details such as full name, email address, and phone number. You’ll also need to verify your identity, which typically involves submitting a photo ID and taking a quick selfie to ensure security.

Step 3: Navigate to Monzo Flex

Once logged in, look for the option to explore Monzo products and select ‘Monzo Flex’ from the list. This section provides detailed information about the credit card, including its features and benefits. It’s important to review this information thoroughly to understand how Monzo Flex can cater to your financial needs.

Step 4: Complete the Application Form

Proceed by filling out the application form with accurate personal and financial information. You’ll be required to provide details such as your employment status and income. Ensure all the information is truthful and correct, as this will influence the approval process.

Step 5: Submit and Await Approval

After submitting your application, Monzo will review your details and determine whether you qualify for the Flex Credit Card. The approval process might take a few minutes up to a few days. You will be notified via the app or email once a decision has been made. If approved, your new Monzo Flex Credit Card will be ready to use, enabling you to manage your expenses flexibly.

GET YOUR MONZO FLEX CREDIT CARD THROUGH THE WEBSITE

Frequently Asked Questions about Monzo Flex Credit Card

What is the Monzo Flex Credit Card?

The Monzo Flex Credit Card is a flexible financing option offered by Monzo, allowing customers to split purchases into manageable monthly payments. It is designed to give users more control over how they manage expenses. Unlike traditional credit cards, it focuses on short-term payment plans, providing flexibility without long-term debt commitments.

How does the Monzo Flex Credit Card work?

When you make a purchase with the Monzo Flex Credit Card, you have the ability to choose a payment plan that suits your financial situation. For example, you can opt to spread the cost over 3, 6, or 12 months. This way, you can tailor repayments to your budget, ensuring that your monthly cash flow remains stable. One key benefit is the transparency in how much you’ll pay back each month, as Monzo clearly outlines the interest and fees up front.

Are there any fees or interest charges with Monzo Flex?

Yes, Monzo Flex includes interest charges, and the rates can vary based on the repayment term you select. However, Monzo often provides promotional periods with interest-free terms for certain repayment plans. It’s crucial to review these terms carefully when choosing a plan, so you understand any potential costs involved over time.

Who is eligible for the Monzo Flex Credit Card?

Eligibility for the Monzo Flex Credit Card typically involves having a Monzo current account and passing a credit check. Monzo evaluates your creditworthiness to determine if you can responsibly handle the repayment terms. If approved, you gain access to a flexible financial tool that adjusts to your changing needs.

How can I pay off my Monzo Flex Credit Card balance?

Paying off your Monzo Flex Credit Card balance is straightforward. You can make payments directly through the Monzo app, ensuring it fits conveniently within your financial routine. By staying on top of your payment schedule, you can manage your credit use effectively and maintain healthy credit habits.

Related posts:

Credit Cards and Consumer Culture: How They Influence Our Daily Purchases

How to Apply for a Barclaycard Platinum Credit Card A Step-by-Step Guide

How to Apply for NatWest Travel Reward Credit Card Easily

The Role of Credit Cards in Financial Education for Teenagers in the United Kingdom

How to Apply for Santander All in One Credit Card Easy Guide

How to Apply for Santander Everyday No Balance Transfer Fee Card

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on our platform. Her goal is to empower readers with practical advice and strategies for financial success.Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on our platform. Her goal is to empower readers with practical advice and strategies for financial success.